Hello everyone! 👋🏻🤖

Today, we’re starting a new segment: The Insider’s Corner. Here, we’ll be speaking to experts and industry players from across the planet who have first-hand knowledge of local AI and are willing to share their insights with our readers.

Dr. Jingtai Liu earned his PhD in Cognition and Cognitive Neuroscience from Michigan State University. After working in the US, he’s now back in China, where he’s employed by a top online travel agency as a people analyst. As part of the job, he has recently begun to utilize LLMs in analyzing employee data.

AIport sat down with Dr. Liu to pick his brain and learn about the state of AI in China and how it’s changing entire industries.

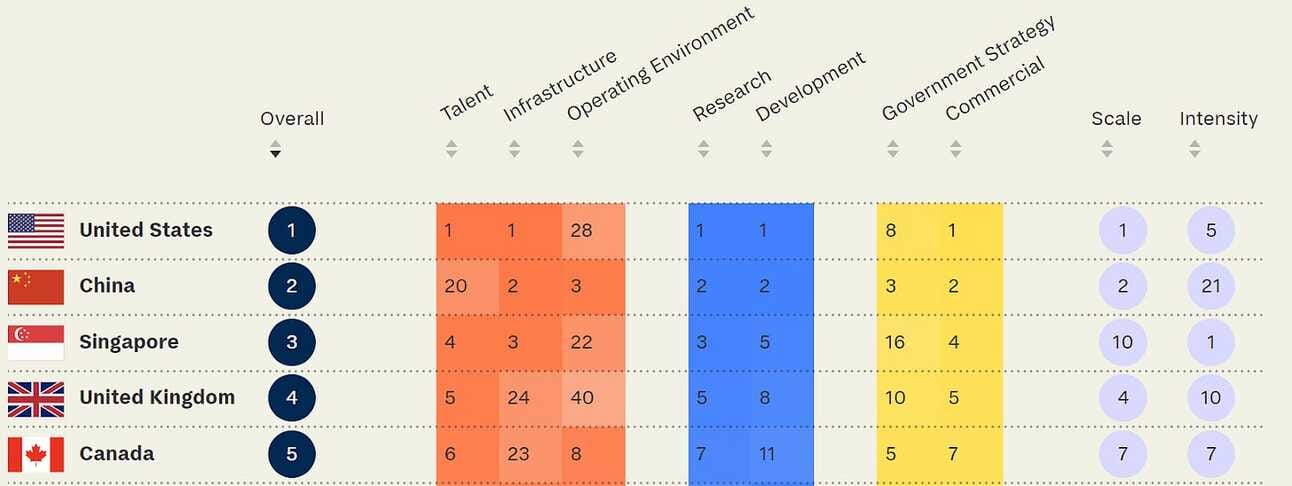

Image by Tortoise Media

Impressively, China is now number two in the world in AI, trailing only the US. As an insider based in China, why do you think that is? What, if anything, makes China’s approach to AI different?

China possesses several advantages compared to the US in developing its own AI path. First of all, China has designated AI as a national priority for its overall economic development. In this respect, the Chinese government has been successful at translating its long-term vision into measurable outcomes.

Secondly, China has vast data resources and diverse application scenarios. With a massive consumer market generating enormous amounts of data every day, China possesses invaluable resources for training AI models. Rapid advancements in areas such as electronic payments, e-commerce, and smart cities have also created a wide range of opportunities for ML-backed tools. This has accelerated both the technological iteration and commercialization of AI in China.

Lastly, China’s strengths in manufacturing and supply chain management have facilitated a deep integration of AI within traditional industries, fostering a much stronger nationwide ecosystem.

While China is excelling at virtually every AI metric where the US is dominant — with a very high absolute AI capacity (“Scale”) — the nation is reportedly lagging behind in “Talent” and also when it comes to AI capacity relative to its size/population (“Intensity”). Why is that and does it surprise you?

Frankly, I don’t believe China ranks 20th in terms of AI talent — this may be a skewed statistic for any number of reasons (such as disregarding cross-continental parameters). As far as I know, the number of Chinese AI professionals is growing at a remarkable pace. Computer scientists in China regularly produce groundbreaking papers, having overtaken the US quantitatively in terms of high-impact peer-reviewed AI research, a fact both verified and accepted by reputable sources outside of China.

Still, there’s a considerable gap between China and the US in terms of top-tier scholars, because China is still relatively weak in fundamental research. Additionally, the nation is facing a serious issue of losing its top AI talent due to AI migration.

While China’s global AI skill penetration rate is impressive (being not far behind the world leader, India), in a way it’s actually eating away at China’s domestic AI growth. If you follow AI research developments, you’ll notice that many of the leading scientists are Chinese, but their breakthrough work is often represented by companies and institutions outside of China.

Most of our subscribers know about OpenAI and Anthropic in the US, DeepMind in the UK, Mistral AI in France, etc. Fewer are familiar with AI companies in China. Which ones should we look out for, both big firms and up-and-coming startups?

Since last year’s AI wave, large tech companies and startups in China have followed suit, leading to the emergence of several noteworthy solutions. Among the most significant creations by China’s Big Tech are Baidu’s Ernie, Alibaba’s Qwen, Tencent’s Hunyuan, iFlytek’s Spark, and ByteDance’s (TikTok’s) Doubao.

Among smaller (but still very promising) players are Moonshot, Zhipu, Baichuan, MiniMax, and 01.ai. These companies currently enjoy large user bases in China and are continually refining and upgrading their models to benchmark against GPT-4. You can check some of their ratings and performance stats on the LMSYS Chatbot Arena Leaderboard. Incidentally, many top contributors on this crowdsourced platform are also Chinese.

What do you think is the best Chinese-made LLM currently? Also, there’s a new tendency in the West to try hybrid architecture and increasingly domain-specific SLMs. Is that something you also observe in China?

Since there hasn’t been any formal evaluation, it’s hard to say definitively which company’s LLM is the best. The AI products I use in a professional setting include Alibaba’s Qwen 2, Moonshot’s Kimi, Baichuan’s model series, and Zhipu’s ChatGLM. In my experience, these products, at least from the standpoint of someone living and working in China, are very much comparable to GPT-4.

And yes, I’ve also noticed that some Chinese companies tend to release small language models alongside their LLM solutions. For instance, not long ago Baichuan introduced a compact model with 7 billion parameters: Baichuan-7B. As for domain-specific SLMs, I would single out MathGPT by TAL for learning math and also HuatuoGPT created by Shenzhen-based researchers for medical applications.

Newer GPUs from companies like Nvidia and Samsung are upping the AI game. Are there any AI chip manufacturers in China you can point to? Also, the US is actively trying to stop the advancement of China’s tech sector, which includes semiconductors. Is it preventing AI companies in China from growing?

AI chip and GPU companies in China worth mentioning include Huawei, Cambricon, and Biren Technology. The US government-imposed restrictions on sharing semiconductor technology with China have slowed the development of AI in the country to a certain extent. But it could also be argued that these sanctions have backfired, not least by making China more self-reliant on its own supply chain and by prompting the nation to place greater emphasis on domain-specific independent research.

In my opinion, this will likely accelerate the localization of China’s semiconductor and ML industries in the long run, thereby improving the country’s overall AI standing and potentially narrowing the gap with the US.

It seems that ByteDance and Alibaba — both Chinese companies — have been deliberately lowering the prices of their AI solutions to instigate what’s referred to as a price war. What do you think is the end goal here and will this battle extend beyond China?

Quite simply, when there are no significant performance differences between LLMs, launching a price war incentivizes more individuals or enterprises to try these products. The more hype there is, the larger the company’s potential market share. Price is always a huge factor, and many businesses, even those seriously considering AI solutions for pipeline optimization, may halt AI adoption due to high maintenance costs.

Naturally, when the price of these models is low enough, more enterprises and individuals will be willing to experiment with them. I believe the slashing of model prices that we’ve been witnessing is a trend, with even players like OpenAI continuously refining its offers for new and existing clients.

Having said that, I’m not convinced this will necessarily escalate into a price war outside my home country, because the sheer intensity of local market competition among LLM makers isn’t as great elsewhere compared to China.

There’s a lot of talk right now about how GenAI is affecting traditional services, including search engines — from Google and Microsoft Bing to Perplexity, You.com, Brave, and Andi. Are companies like Baidu from China’s National AI Team integrating GenAI into their searches or other products? Anything like the Humane AI Pin or Rabbit r1 around?

I believe Baidu is being more cautious than Microsoft and Google when it comes to assimilating its LLM into existing web search, which is why the company’s GenAI integration isn’t very apparent, at least not yet. According to Baidu's CEO Robin Li, only “11% of the search results on Baidu are generated by AI.” However, the company does have a standalone AI search app called Simple Search (简单搜索), which works in much the same way as Perplexity.

In other words, at present Baidu has both traditional and AI-backed search routes open, choosing to keep them separate for the time being and thus avoiding potential problems, such as Google’s widely criticized hallucination debacle from May. Concurrently, the company is focused on other AI initiatives, including its AI cloud tailored for the commercial sector. There are other well-put-together AI search engines in China as well, including Metaso, TianGong, and 360 AI.

As for the progress in China’s AI-powered hardware, I don’t consider myself an expert in this field. With that said, as far as I know, there are currently no products in China on par with the Humane AI Pin or Rabbit r1. I’d say this is because most of China’s AI efforts, apart from AI chips, are in software right now, extending primarily to smartphones and increasingly also automobiles.

Expectedly, new AI tools are also changing how modern professionals operate. What about your own job specifically? Can you give us an example?

This is certainly the case. Machine learning has deeply penetrated my daily workflow, be it using AI tools to generate code, dissect algorithms, brainstorm solutions, or acquire new knowledge. All in all, as a scientist, I feel that AI gives me more confidence, bolstering my ability to solve complex problems.

For example, during a recent analysis my team and I carried out, we collected, processed, and subsequently aggregated open-ended responses from thousands of the company’s employees. I utilized OpenAI’s API to extract topics/keywords and generate summaries from these texts — a task that would have been much more difficult to conduct with traditional NLP techniques.

In short, for academics and R&D people who are tackling specific tasks, using AI ultimately comes down to precision and speed.